Learn how UWECI utilizes its large network of resources to help individuals in East Central Iowa.

Someone who could be considered financially stable might spend money every day with very little thought or stress. This could include buying a coffee on the way to work, using automatic withdrawal to pay bills, or getting a regularly scheduled oil change on their car.

These decisions can often be taken for granted by financially stable individuals, while those experiencing financial instability are deciding which essentials can even be afforded on a given day. Sacrifices are required—should a meal be skipped tonight so a bus ticket can be purchased tomorrow? Should a required prescription remain unfilled this week so rent can be paid next month?

United Way of East Central Iowa helps these individuals and families by pinpointing the greatest needs in our community through research, supporting programs that fill these gaps of service, and encourage collaboration to help tens of thousands of residents in East Central Iowa.

Did you know that in UWECI’s five-county service area:

- $41,560 is the required household income to live financially stable[i]

- 18% of families do not meet the financially stable threshold[ii]

- The unemployment rate is 3.7%[iii]

Below are a few ways UWECI and its community partners and programs are working to support those experiencing financial instability.

Housing: In UWECI’s five-county service area, more than 1 in 3 renters and 15% of homeowners are housing cost burdened.[iv] This means they spend over 30% or their monthly income on housing. Last year, through our financial stability community partners and programs, 834 potentially homeless individuals were diverted from shelter or assisted with housing. Research shows that stable, affordable housing has health benefits including reduced stress, improved self-esteem, and greater access to better nutrition.[v]

Housing: In UWECI’s five-county service area, more than 1 in 3 renters and 15% of homeowners are housing cost burdened.[iv] This means they spend over 30% or their monthly income on housing. Last year, through our financial stability community partners and programs, 834 potentially homeless individuals were diverted from shelter or assisted with housing. Research shows that stable, affordable housing has health benefits including reduced stress, improved self-esteem, and greater access to better nutrition.[v]

Access to Food: The United States Department of Agriculture defines food security as access to enough food for an active, healthy life by anyone at any time.[vi] Families are considered food insecure if they’re forced to make the decision between expenses such as utilities or medical bills and adequate nutritional food—over 31,000 people in our five-county service area are food insecure.[vii] Last year, 6.87 million lbs. of food were distributed by UWECI community partners and programs to our five-county service area.

Access to Food: The United States Department of Agriculture defines food security as access to enough food for an active, healthy life by anyone at any time.[vi] Families are considered food insecure if they’re forced to make the decision between expenses such as utilities or medical bills and adequate nutritional food—over 31,000 people in our five-county service area are food insecure.[vii] Last year, 6.87 million lbs. of food were distributed by UWECI community partners and programs to our five-county service area.

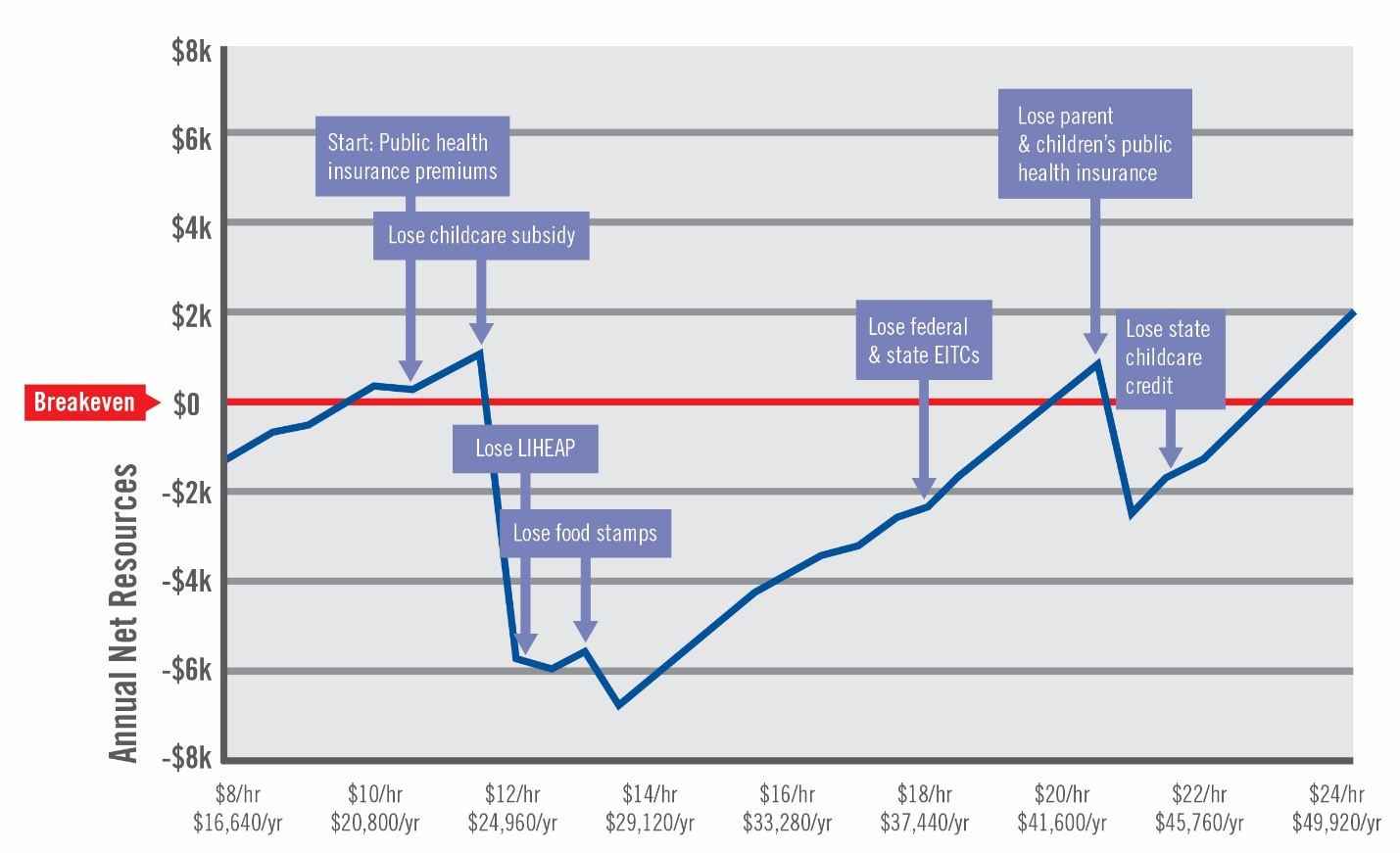

Financial Fragility: ALICE (Asset Limited, Income Constrained, Employed) households are those with incomes above the federal poverty level but below the required amount to afford basic needs such as housing, childcare, food, transportation, and healthcare. In our five-county service area, 31% of households are below the ALICE threshold.[viii] Government programs provide some financial support; however, eligibility is often based on income, which leaves many households in a challenging situation, also known as the “Cliff Effect.” The Cliff Effect occurs when individuals or families earn an increase in income, but the increase disqualifies the family for assistance. What may have appeared to be a positive feat often leaves the household worse off (for example, an income increase of $1,000/year often does not cover the value lost in assistance such as a $2,000 childcare credit). Below is a visual example of what the Cliff Effect could look like.

Financial Fragility: ALICE (Asset Limited, Income Constrained, Employed) households are those with incomes above the federal poverty level but below the required amount to afford basic needs such as housing, childcare, food, transportation, and healthcare. In our five-county service area, 31% of households are below the ALICE threshold.[viii] Government programs provide some financial support; however, eligibility is often based on income, which leaves many households in a challenging situation, also known as the “Cliff Effect.” The Cliff Effect occurs when individuals or families earn an increase in income, but the increase disqualifies the family for assistance. What may have appeared to be a positive feat often leaves the household worse off (for example, an income increase of $1,000/year often does not cover the value lost in assistance such as a $2,000 childcare credit). Below is a visual example of what the Cliff Effect could look like.

More information on financial stability in our community can be found in the reports below.

[i] Families USA. (2018). Federal Poverty Guidelines. https://familiesusa.org/product/federal-poverty-guidelinesNote: Financial Stable Income is required amount to stay above 200% FPL for family of 3.

[ii] U.S. Census Bureau. (2017) American Community Survey 5-Year Estimates. Table S1702

Note: 5-County Families in Poverty 14,234 / 5-County Family Households 78,696 = .18

[iii] U.S. Census Bureau. (2017) American Community Survey 5-Year Estimates. Table B25119

Note: 5-County Labor Force 164,944 / 5-County Unemployed Pop 6,049 = .037

[iv] U.S. Census Bureau. (2017) American Community Survey 5-Year Estimates. Table DP04

[v] Maqbool, Viveiros, Ault. (2015). The Impacts of Affordable Housing on Health: A Research Summary. Center for Housing Policy. https://www.enterprisecommunity.org/download?fid=8265&nid=4141

[vi] U.S. Department of Agriculture. (2019). Food Security in the U.S., Overview. Economic Research Service. https://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us.aspx

[vii] Map the Meal Gap. (2017). Food Insecurity by County. Feeding America. https://map.feedingamerica.org/county/2017/overall/iowa

[viii] United Way. (2018). ALICE: A Study of Financial Hardship in Iowa